Most members are complaining that they are not able to find good bargains because of the current stock market rally. We disagree there are couple of bargains available right now, check out the Valuation Screener to find them. There is one stock which is available at a huge discount right now but today we are going to tell why you should definitely avoid this stock. Karnataka Bank is currently under valued as per the valuation screener. Its intrinsic fair value is more than the current market price but that does not mean that you should buy it blindly.

Does it make sense to buy Karnataka Bank just because it is cheap right now? First of all never invest in any company just because the share price is cheap. We have to look at the financial charts of the company to see if the company is fundamentally good or not.

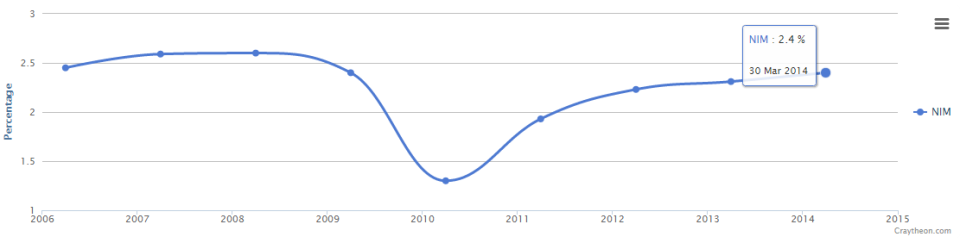

Lets look at the Net Interest Margin chart, NIM is the most important ratio when it comes to evaluating banks. It is the difference between the interest income generated and the interest expense paid, divided by total assets. An ideal bank should have NIM above 3%. If you look at Karnataka Bank’s NIM chart for the last 9 years you will see that its NIM never went above 3%. That is not a good sign.

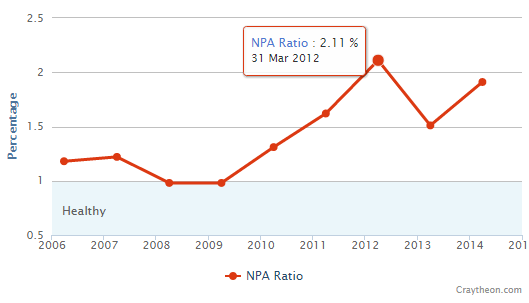

Next we will look at the Non Performing Assets Ratio. NPA Ratio is used to measure asset quality of the bank’s loans. NPA are those assets for which interest is overdue for more than 3 months. If you stop paying your home loan EMI for more than 3 months then your loan account is considered to be a non performing asset.

Another important thing about banks is that you have to figure out if the management at the top is good or not. Big investors like Buffett and managers of mutual funds can directly talk to the managers of the bank. Investors like us cannot. So how do you figure out if the management of the bank is good and efficient. We look at the NPA Ratio chart, it acts like a proxy for the management. If the NPA Ratio is less than 1%, it means the bank’s loan book is healthy, above 1% is not healthy. If the NPA ratio is less than 1% for the last 10 years then that is a sign of a good bank with a terrific management.

Just look at Karnataka Bank’s NPA Ratio chart. It is atrocious.

On the other hand if you look at HDFC bank’s NPA chart, its NPA ratio has never gone above 1% in the last 10 years. That is a sign of well managed bank.

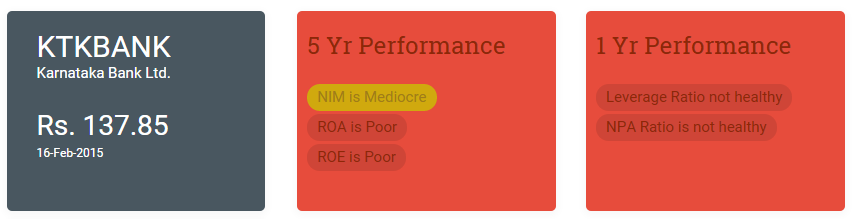

So Karnataka bank has bad NIM and a very bad NPA Ratio, its not being managed well, its not a good long term investment. You should avoid investing in Karnataka bank even if the share price is cheap.

You don’t even have to look at the Summary Page to know that its a bad investment.

Can we invest for short term, so that we can profit it this stock rallies in short term?

LikeLike

You wont be investing, you would be speculating, there is a difference between the two.

LikeLike

It is realy informative. very good!!!

LikeLike

Thank you Puru

LikeLike

A really good article. Can we have similar articles to evaluate companies from other sectors please?

LikeLike

Thank you Prakash, Yes, we are going to add similar articles which will help you evaluate companies from other sectors as well.

LikeLike

Just wondering,

Where do you get your info from?

LikeLike

cvas, we get the all info from the annual reports. We dont trust other financial database companies since they dont have reliable data, so we get the data ourselves from the company’s annual report.

LikeLike

Good analysis of Kanataka Bank.

Can we identify undervalued energy and pharma stocks ?

LikeLike

This was fantastic. Very useful and easy to understand for people with not much financial/stock knowledge. Have heard that Craytheon in US was good. Happy to see it doing the same great job here. Thank you and Best Wishes.

LikeLike

NPA’s appear to be the best way for senior Bank officials to make money – the modus operandi being simple – ignore the siphoning off that is being done by the crook borrowers and instead just give more and more funding in return for personal gain. It is said that top officers of SBI and ICICI are also involved in this dirty game. SBI, the oldest and the largest Indian PSU is actually the bad apple that is rotting the entire system. It has at the helm of affairs people like Mr. Sunil Shrivastava (DMD) and Mrs. Arundharti Bhattacharya (Chairman) who are only bothered about their own skin in the game and their concern for the economic state of the nation is all crocodile tears. Mr. Sunil Shrivastrava is known for backing bad loans and being the best supporter of fraudsters. One must remember that he was the first one to refrain from tagging Vijay Mallya as a “wilful defaulter’ during early days. At present too he has provided his blessings to various accounts that are either stressed (Ganesh Jewelry) or have just obtained refinancing and are planning their next move to be a defaulter (Usha Martin). While the former examples are all over the media, it is interesting how accounts like Usha Martin (with his co conspirator, MD Rajeev Jhawar) are being used as the pipeline for India’s next big NPA account. Refinancing has been provided to Usha Martin, despite wrong projections being blatant on balance sheet, it is no secret that the mining industry is under huge stress, despite that the company was offered refinancing on favourable terms. Mr. Rajeev Jhawar has ensured that he and his family would be safe post the account turning NPA , as they are all ready to shift to Singapore (where he has other business interests). It is not that these are not known to SBI or Mr. Sunil Shrivastava – they are just turning a blind eye as Mr. Shrivastava has secured his retirement wealth through the gains that Mr. Rajeev Jhawar has provided. How can NPA really be resolved, till such corrupt bank officials are allowed to be decision makers? How can genuine borrowers be trusted when defaulters like Rajeev Jhawar are allowed to not only commit fraud but given more and more ammunition over the years for siphoning off?

LikeLiked by 1 person

It is time if craytheon can update the summary of atleast some of these stocks. The data that is present in summary page is more than a year old

LikeLike

Sharath, we update the analysis after annual report is published or if there are some major news about the company.

LikeLike

excellent knowledge.would love to follow you.but unable to find you on wordpress.please find me by ‘[email protected]

LikeLike