Our last blog was 1 year back that is way too long in the world of internet. Last year in Jan and Feb share prices were dropping down specially in the banking sector because of the NPA crisis. RBI had made the banks to be more transparent and declare the non performing assets on their books. When the banks started doing that, the market panicked.

We said last year in our blog that there are some good companies which are undervalued and it’s a good time to buy them. Let’s talk about that.

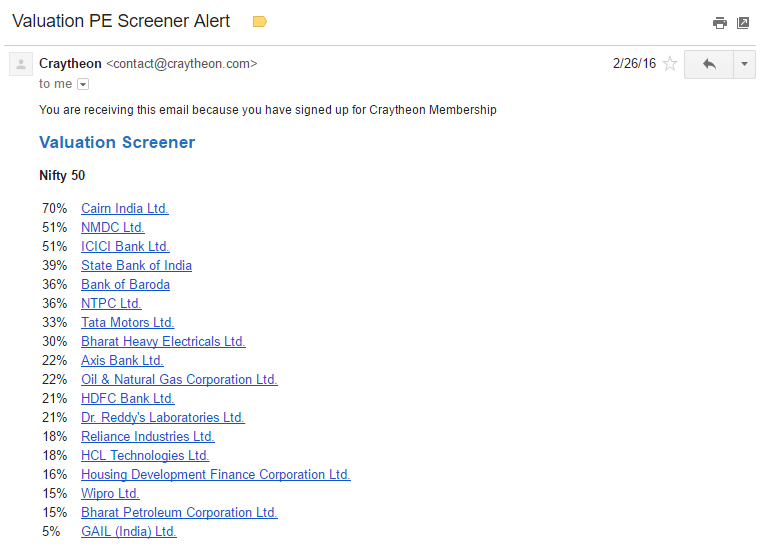

We send an email to all our Professional members end of day which gives a list of stocks which are undervalued compared to their intrinsic value.

As you can see in the above image there were many banks which were undervalued. All banking stocks had seen huge drops in their share price because of all the negative news about Non Performing Assets on their books. Smart investors should patiently wait for such crisis and buy stocks in fundamentally good companies.

Let’s start with ICICI Bank which was selling at 51% discount. Now if you read our company analysis then you would know that we are not big fans of ICICI Bank because of their aggressive lending policies but it was selling at such a huge discount we had to buy it. In Feb 2017 the stock is up 45%.

The two more banks we bought were Axis Bank and HDFC Bank, if you look at Valuation Screener Email you would see that both of them were available for around 21% discount. If you read our company analysis we like both of them. Both the stocks are up 40%.

There are two more banks in the undervalued list, SBI which is up 60% and Bank of Baroda which is up 20% compared to last year. We have already mentioned in our company analysis about the two banks that investors should be cautious in investing in those two stocks because of Govt meddling and high NPA ratios. We did not invest in them.

One year later you get these fantastic returns of 40 to 45% but are they really good, to check that you should compare your returns with Nifty, if you returns are below Nifty then you did a terrible job. Nifty returns for the same time period were 25% so investors who bought the shares of those 3 banks in Feb 2016 definetly got terrific returns.

That is all you have to do, you patiently have to wait for such opportunities and grab them when they arrive. Last year’s NPA crisis in the banking sector was one such example.

As always please do not call or email us for stock tips or advice.