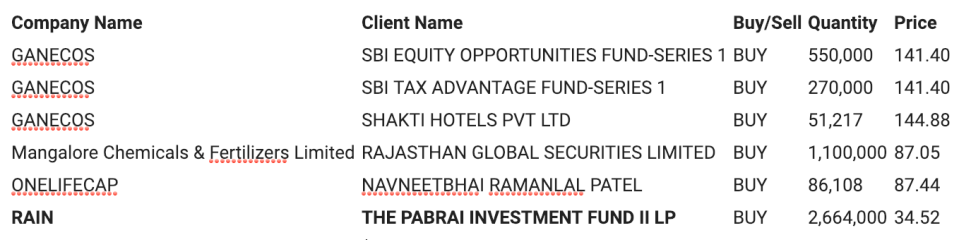

We email the Insider Trading and Bulk Deals report every end of day to our professional members, it contains the list of companies whose insiders or other institutional investors are buying or selling the shares. Monitoring such transactions is very important for investors. As investors you can see if the promoters or other big investors are buying shares of a company. Once you see that activity you can do your due diligence about the company and buy the shares and ride the wave.

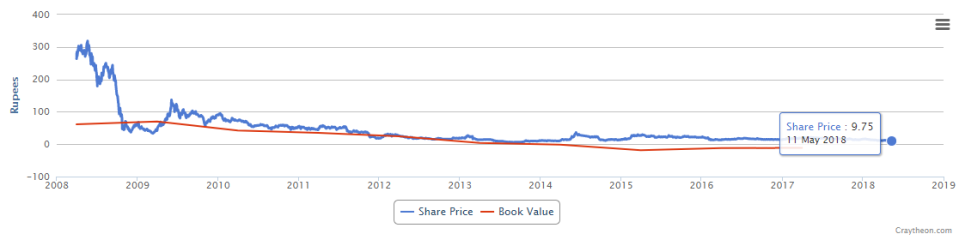

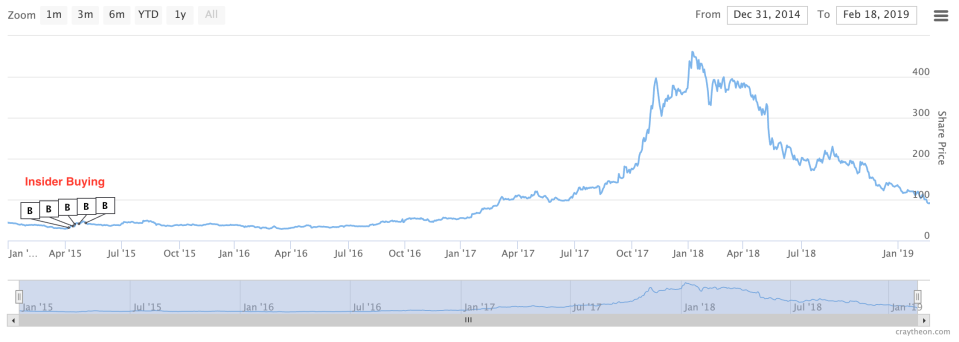

Back in April 2015, Monish Pabrai who is famous investor in the US (and now India) was buying shares of Rain Industries when its share price was between 30 Rs and 40 Rs.

Monish Pabrai Rain Industries Email Alert

The share price pretty much languished for 1 year and then slowly started rising and then shot up like rocket and reached a peak of 460 Rs in Jan 2018. A massive 1000% profit, if at that time you decide to hold the shares and not sell till today you would have seen massive fall to 95 Rs. Monish Pabrai as per his letter to investors did not sell most of his shares. He regrets that decision.

So if you are an individual investor there is no guarantee that a company’s share price will keep on going up just because a famous investor has invested in it. If you are going to copy the trades of a famous investor sometimes it makes sense to get out with a tidy profit and not get greedy.

Rain Industries Insider Buying

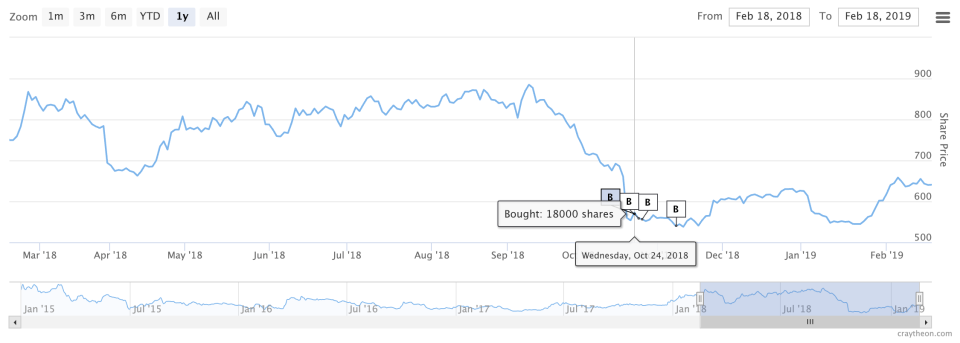

Persistent

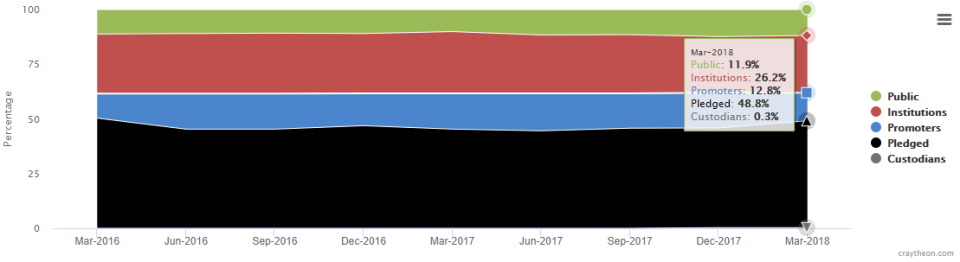

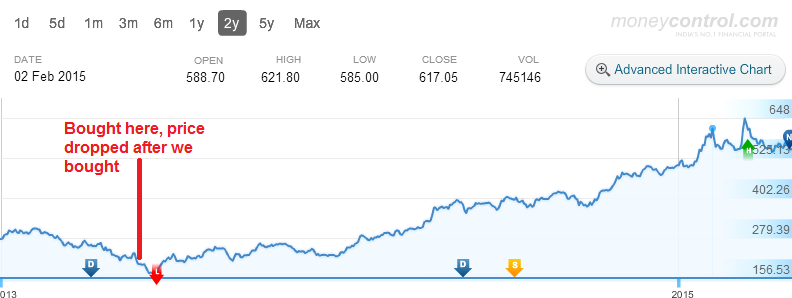

Let’s jump to Persistent where if you read the Insider Trading Email you would seen the founder and chairman of Persistent Anand Deshpande and other Persistent Insiders buying the shares. The share price had crashed to around 550 Rs. It was in that range for 2 months then rose to 630Rs for couple of months then fell again to 550 Rs in Jan. We bought a small position in Oct and Jan and were waiting for the price to fall further. Unfortunately the price did not fall further it kept on rising. Let see how Persistent plays out. We will keep you posted meanwhile keep checking the Insider Trading emails.

Persistent Insider Buying

Disclosure – Long Persistent