The stock market is near peak bubble territory. Check the long term NSE PE Ratio chart to see what happened when the PE ratio touched 25. Of course this does not mean there will be crash soon, nobody can predict that but if you look at history then it would make sense not to invest right now.

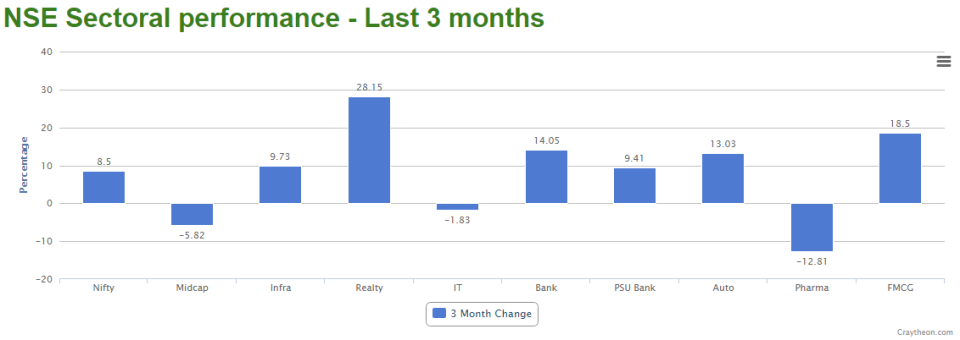

The share price of most companies is overvalued right now finding good investment opportunities has become difficult but there is hope. Look at the NSE Sectoral Performance for the last 3 months.

Most of the sectors have given good returns except IT and Pharma. The companies in the Pharma sector have been facing tough times. Such adverse conditions are good news for patient value investors because investing in companies who have taken a beating gives enormous returns down the line. The only condition is you have to analyse which stocks to invest in that sector.

Companies like Sun Pharma, Lupin, Divis Lab, Dr Reddy’s which were once the darlings of Pharma sector have taken a significant beating. Most of Pharma companies faced the wrath of US FDA due to tighter regulations.

Despite the short term bad news, Pharma companies are not going anywhere, they have promised to fix all the regulatory issues. We believe it’s a good time to invest in the Pharma sector. Of Course there is always a possibility that the share price of Pharma companies can fall even more, if that happens you will get to buy them cheaper. You can check our charts, valuation models of the individual pharma companies to see which ones are fundamentally good or bad. If you don’t have the tenacity to do the research you can invest in a Pharma mutual fund.

So even though the market is overvalued there are some hidden gems provided you know where to find them.

I agree, I have invested in Lupin and Divis, they are very undervalued

LikeLike

I disagree. Look at the latest quarter results for Sun Pharma. The earnings are declining, due to increased competition in US market, and the decline may continue next year. So, from fundamental perspective, the Pharma sector appears fairly valued. From technical perspective, investing right now would be like catching falling knieves.

LikeLike

All bad outcomes are priced-in. When cos. underperform, they cant continue to underperform. The investors/ board push their staff to change strategy or correct course or change the strategy after a lot of ideation. I am sure, the pharma cos. would have done that in last 6 months and might be ready with new actions which will stop them from further going down, and they will slowly start performing. And all this of next 6 months to 2 -3 years actions and outcomes are not yet priced in the stock of good pharma cos. I have been working in such good co. for last 20 years, and that has how happened there also. How does it sound.. my friend?

LikeLike

I agree that there are opportunities to be found in the pharma sector – particularly companies that are focused on domestic sales rather than exports. While near term challenges remain, the current valuations offer a good entry point for long term investors. Stock selection will be key however.

LikeLike

Yes Glenmark, Lupin, Divislab , Strides Shasun …Buy on dip

LikeLike

Pingback: Divis Lab – Update | Craytheon

I don’t even know how I ended up right here, however I assumed this submit was once great.

I do not recognize who you are but certainly you are going to a famous blogger when you

are not already. Cheers!

LikeLike