When promoters pledge their shares, its a sign that the company cannot raise funds from other normal sources because banks are afraid that the company may not pay back the money, so the banks make the promoters pledge their shares to them. In simple words the promoters gives the rights to the bank to sell the shares if in case the company does not payback the loan. If during the loan tenure the share price of the company falls beyond a limit which is set by the lender, it triggers a margin call, the lender can demand that the loan be repaid or more shares to be pledged. If the promoter cannot repay or offer more shares, the bank can invoke the pledged shares aka sell those pledged shares which causes further fall in the stock price.

We always recommend that investors should avoid companies which have high debt, high debt companies not surprisingly are the ones whose promoters have to pledge their shares. Let us compare the stock price performance of some companies which have pledged their shares.

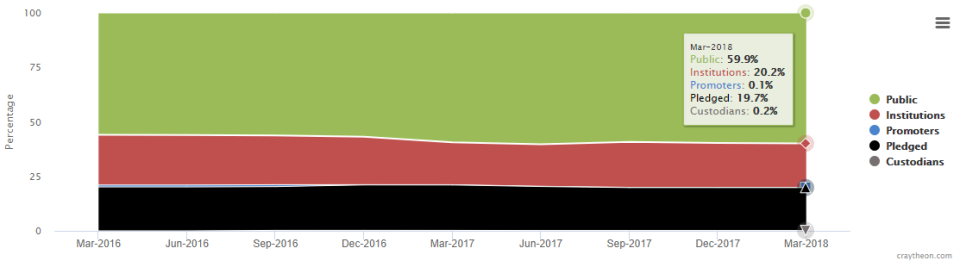

Suzlon has 20% of their shares pledged, that is a significant number.

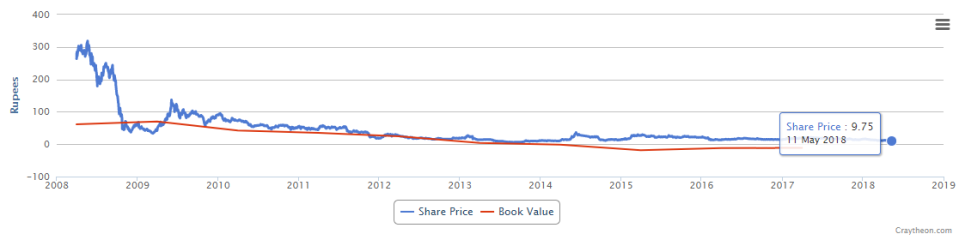

Suzlon’s share price has not done so well over the years.

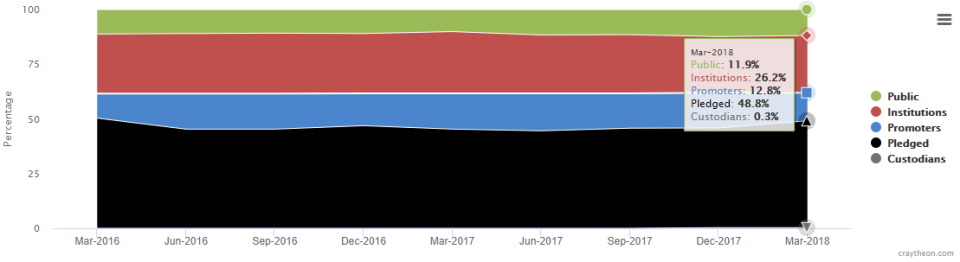

GMR Infra have 48% shares pledged, that is huge.

As expected, the stock performance has been very poor.

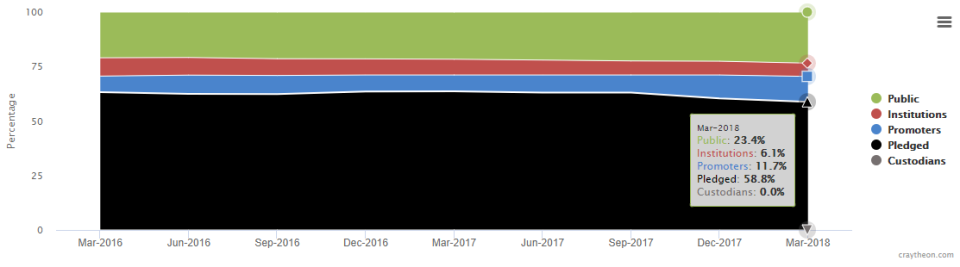

For the last example we will look at PARSVNATH Developers which has 59% shares pledged, that is just crazy.

Any guess how its share price performed over the years?

We can give many such example but hope you get the point.

As you can see from the above charts, there is no good reason to invest in companies which have pledged their shares, these companies have a tough time paying back their interest payments because overall the company is not doing so good which ultimately reflects on the stock price. Just by looking at the shareholding chart in the Insiders Page you can make the decision in less than a minute whether to invest or not. You can save your time, money and stress by ignoring such bad companies.

I had invested in Suzlon because I belived in renewable energy and Suzlon would have been a winner, big mistake

LikeLike

Interesting article.

LikeLike