At the start of 2020 if anyone would have told you that almost all major economies of the world would grind to a halt and a new bear market would begin in just two months all because of a microscopic virus from China, you would not have taken that news seriously but here we are.

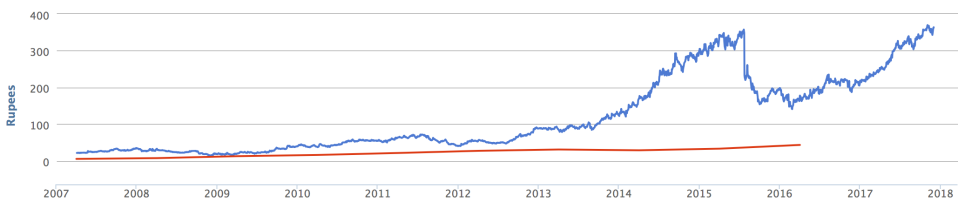

We were in a 10 year Bull trend, everyone forgets the bad times since almost all stocks are rising, you become overconfident and complacent.

Nifty 50

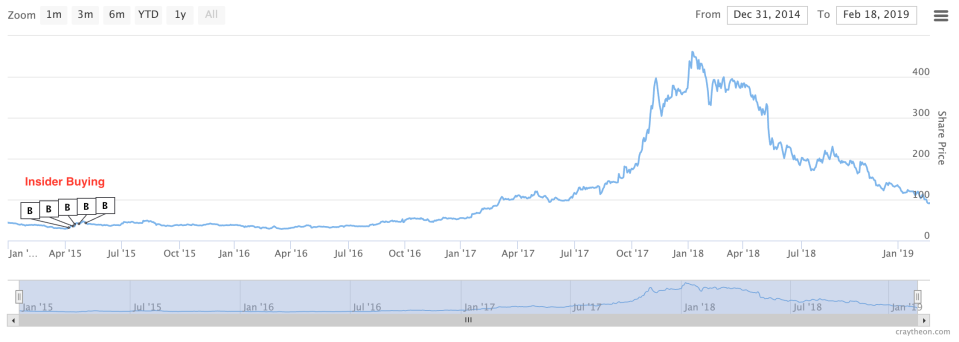

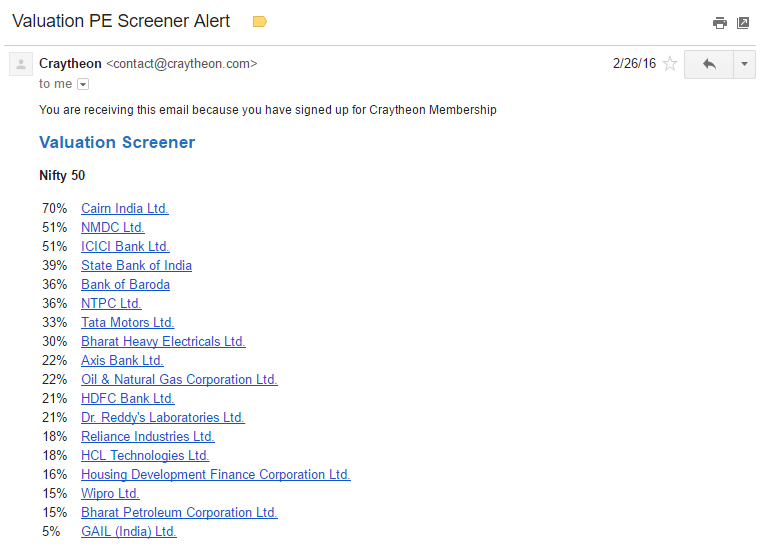

If you were watching the Nifty PE ratio chart you would have seen that the Nifty PE ratio was above 27 for almost a year so it was over valued and due for correction but that is the problem no one knows when the market would correct and what would be the trigger.

Back in 2007, when interest rates started to rise in the US causing home loan defaults which triggered the bear market but this time interest rates were already low so there was no easy signal to spot. Enter Corona Virus, like a Hollywood disaster movie where a virus infects the world, no one takes it seriously until its too late which is what happened pretty much in real life.

Now most of the countries are in shutdown mode to prevent the spread of the virus but the downside is that this is going to affect people and their jobs, which has a cascading effect on almost everything. People talk about world wars and 2008 GFC but this is bigger than those events, this is a once in a 100 year event. If you have cash sitting in your account this is going to be a great opportunity to buy some of the best companies in India at discount prices. The problem is no one knows how long the markets are going to fall.

If this is the first time you have experienced a bear market and your portfolio is in red, and you are wondering what to do, it depends, if you have good companies and you haven’t sold yet then don’t sell instead keep on buying in small amounts. Ofcourse don’t listen to our advice blindly in the end you have to make your own decision.

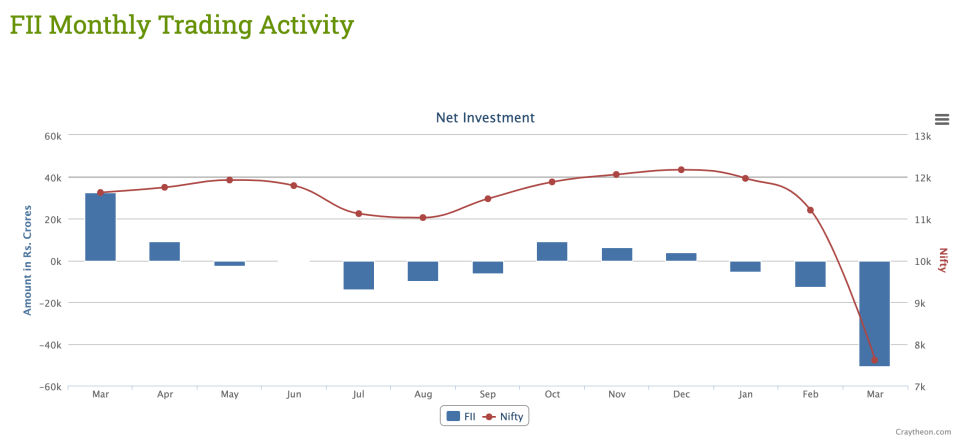

We sold some shares two weeks back, did not sell some others because we thought it would not get so bad and the shares we did not sell are in good companies so we did not see a reason to sell, in hindsight we should have sold everything two weeks back. What are we doing now, we are just sitting on the sidelines and watching the FII DII Trading Activity When foreign institutions start buying again that is usually a good sign to jump back in.

Just be sure that whatever you do does not cause you to lose sleep at night, most bear markets last around a year but because we are in uncharted territory, no one knows how long this will last, central banks have started pumping money into the system but if the virus keeps on killing and people are in lockdown that money is of no use.

P.S – Wash your hands regularly and avoid touching your face.